AI Claims Triage Automation in 2026: Why Claims Operations Are Being Rebuilt

By 2026, ai claims triage automation has become a foundational capability in modern insurance operations. Insurers no longer view claims triage as a manual intake task. Instead, it is treated as a real-time decision layer. This shift is driven by rising claim volumes, complex documentation, and customer expectations for faster resolutions. Consequently, AI-powered claims triage is now central to operational resilience and profitability.

What Is AI Claims Triage Automation?

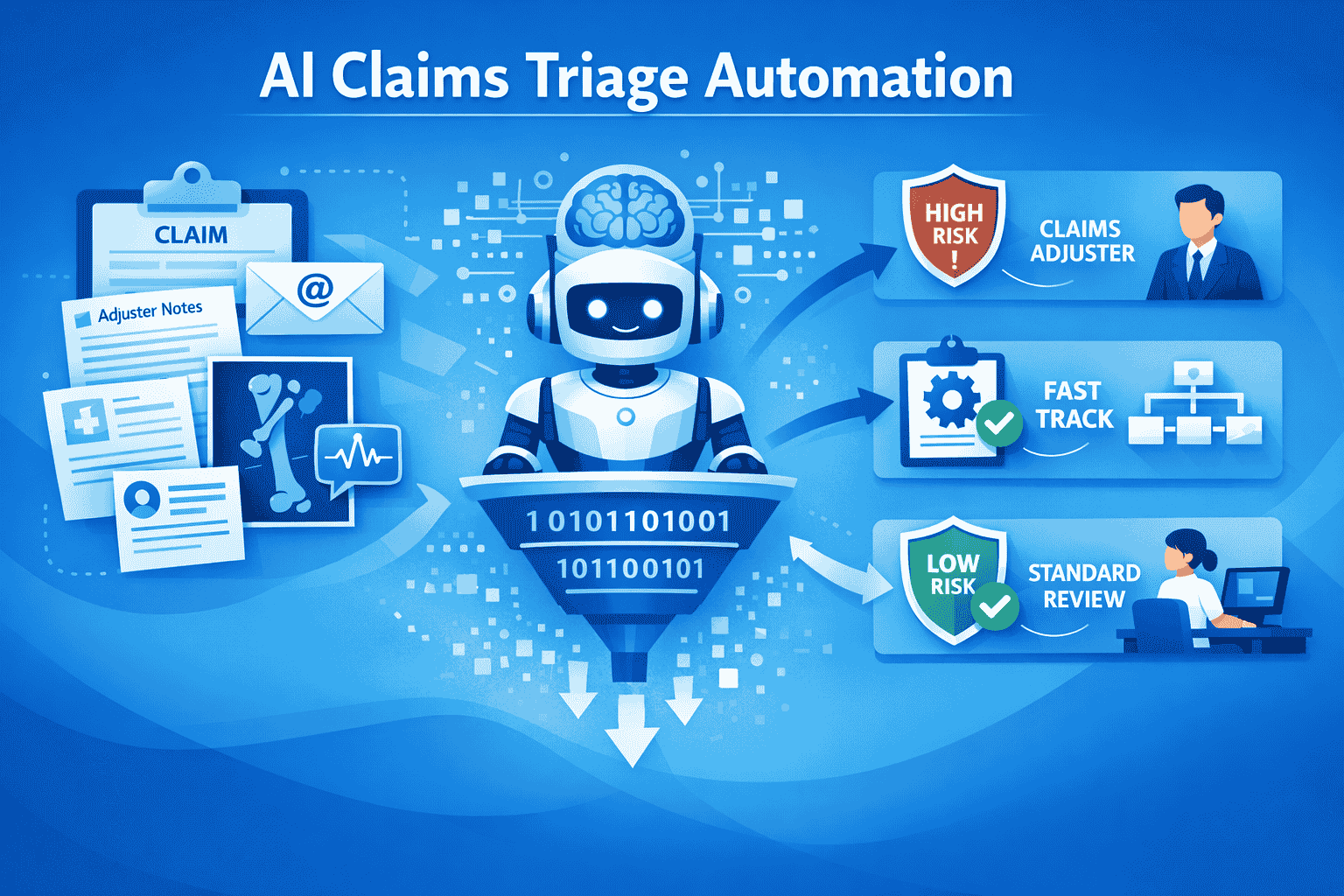

AI claims triage automation refers to the use of artificial intelligence to automatically classify, prioritize, and route insurance claims. These systems analyze structured and unstructured data at submission time. This includes adjuster notes, emails, images, medical reports, and voice transcripts. As a result, claims are assigned to the right handler, workflow, or automation path without manual intervention.

From Manual Sorting to Intelligent Orchestration

Traditional claims triage relied on inbox-based workflows and human judgment. This approach created bottlenecks and inconsistencies. AI claims triage automation replaces inboxes with intelligent orchestration layers. These layers evaluate claim complexity, risk, and urgency in real time. Therefore, insurers gain speed, consistency, and transparency.

Why AI Claims Triage Automation Matters More in 2026

The importance of ai claims triage automation has intensified due to systemic pressures. Climate-related events increase claim frequency and volatility. At the same time, skilled adjusters are harder to hire and retain. Consequently, insurers must process more claims with fewer resources. AI-driven triage becomes the only scalable solution.

Customer Expectations Are Resetting Claims SLAs

Customers now expect near-instant claim acknowledgment and clear next steps. Delays damage trust and retention. AI claims triage automation enables immediate classification and routing. Therefore, insurers meet modern service expectations without increasing headcount.

Core Technologies Powering AI Claims Triage Automation

AI claims triage automation is not a single model. It is a layered system combining multiple AI capabilities. These technologies work together to interpret data, assess risk, and trigger actions.

Natural Language Processing for Unstructured Claims Data

Most claim information arrives in unstructured formats. NLP models extract intent, entities, and context from text and speech. This allows AI to understand loss descriptions and adjuster notes. Consequently, triage decisions reflect real claim content, not just form fields.

Computer Vision for Image and Document Analysis

AI claims triage automation increasingly uses computer vision. Images of damage, medical documents, or receipts are analyzed automatically. These signals help estimate severity and complexity early. As a result, insurers reduce manual review cycles.

Decision Engines and Business Rules

AI models operate alongside configurable decision engines. These engines enforce policy rules, compliance constraints, and risk thresholds. Therefore, triage decisions remain explainable and auditable.

AI Claims Triage Automation Across the Claims Lifecycle

AI claims triage automation impacts multiple stages of the claims lifecycle. Its value extends beyond intake into downstream processing.

Intelligent First Notice of Loss (FNOL)

At FNOL, AI triage evaluates claim completeness and urgency instantly. Simple claims are routed to straight-through processing. Complex claims reach senior adjusters immediately. This reduces cycle time from the first interaction.

Dynamic Claims Routing and Re-Routing

Claims change as new information arrives. AI claims triage automation continuously reassesses claims. If risk increases, routing updates automatically. Consequently, insurers avoid static assignments that slow resolution.

Operational Benefits of AI Claims Triage Automation

The operational impact of ai claims triage automation is measurable and strategic. Benefits extend across cost, speed, and workforce efficiency.

Reduced Claims Handling Costs

Automation reduces manual sorting and reassignment. Adjusters focus on high-value decisions instead of administrative tasks. Therefore, cost per claim decreases significantly.

Improved Adjuster Productivity and Retention

AI claims triage automation removes repetitive work from adjusters. This improves job satisfaction and reduces burnout. As a result, insurers retain experienced talent longer.

Risk Management and Fraud Detection Through AI Claims Triage Automation

AI claims triage automation plays a critical role in early risk detection. Fraud signals often appear at intake, not later stages.

Early Fraud Signal Identification

AI models compare claim patterns against historical data. Inconsistencies trigger alerts before payment processing. Therefore, insurers reduce leakage and investigation costs.

Severity Prediction and Loss Control

Predictive models estimate potential loss severity early. Claims with escalation risk receive proactive intervention. This enables better reserving and capital planning.

AI Claims Triage Automation and Regulatory Compliance

Regulation remains a major concern for insurers adopting AI. By 2026, governance expectations are higher than ever.

Explainability and Auditability

AI claims triage automation systems must explain routing decisions clearly. Transparent decision logs support audits and dispute resolution. Consequently, insurers maintain regulatory confidence.

Data Privacy and Consent Management

Claims data is sensitive by nature. AI platforms enforce encryption and access control. Consent tracking ensures compliant data usage across workflows.

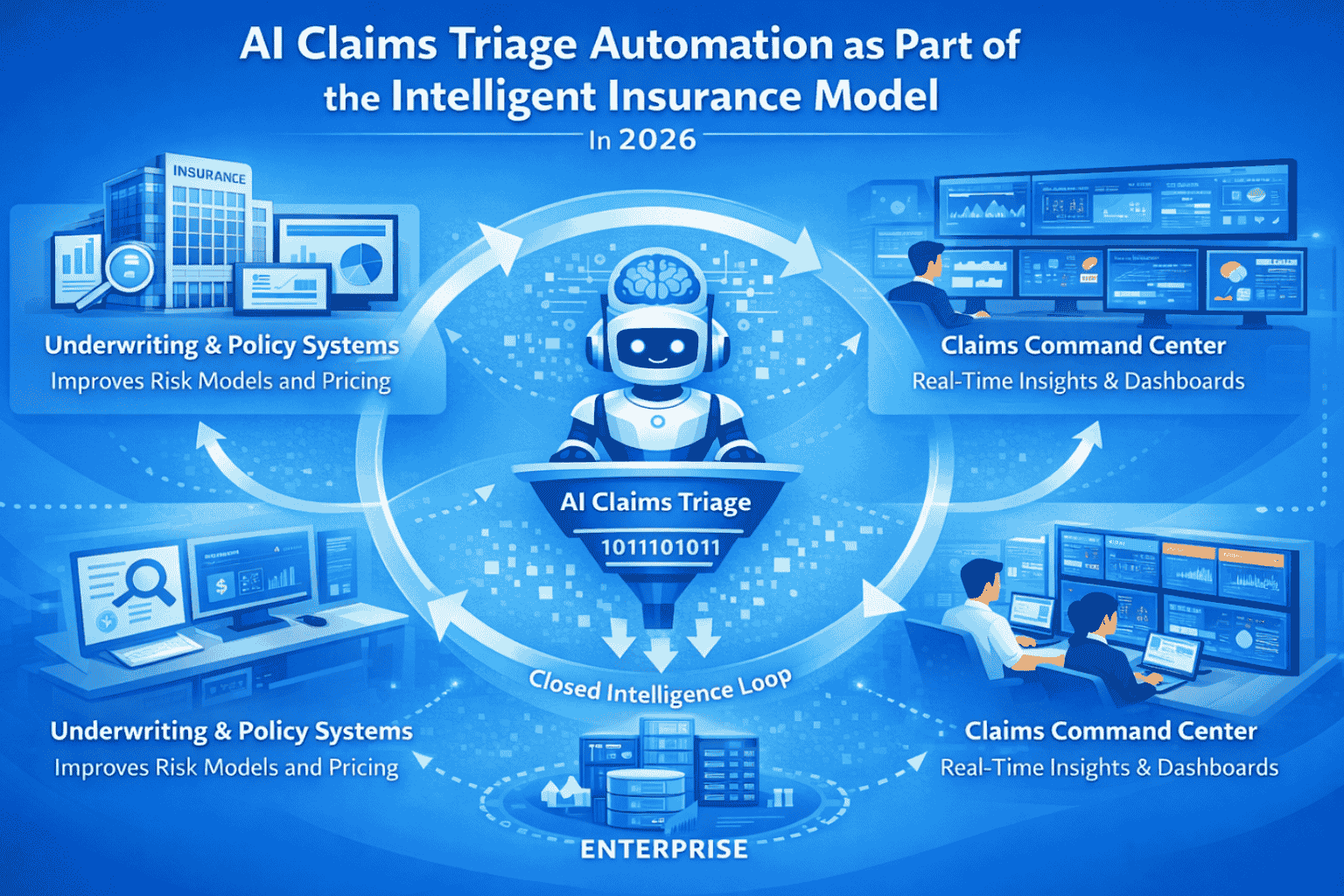

AI Claims Triage Automation as Part of the Intelligent Insurance Model

In 2026, insurers increasingly adopt the intelligent insurance model. AI claims triage automation is a core pillar of this architecture.

Integration with Underwriting and Policy Systems

Claims insights feed back into underwriting and pricing engines. Risk models improve continuously using claims data. This creates a closed intelligence loop across the enterprise.

Command Centers for Claims Operations

Leading insurers operate claims command centers. AI triage dashboards provide real-time visibility into volumes, risks, and bottlenecks. Therefore, leaders manage claims proactively.

Trends Shaping AI Claims Triage Automation in 2026

Several trends define the evolution of ai claims triage automation in 2026. These trends move systems from automation to autonomy.

Agentic AI for Claims Operations

AI agents increasingly manage end-to-end triage decisions. Human oversight focuses on exceptions and governance. This marks a shift toward semi-autonomous claims operations.

Real-Time Streaming Claims Analytics

Event-driven architectures enable sub-second triage decisions. Claims are evaluated continuously as data streams in. This improves responsiveness during catastrophe events.

How SourceCode Approaches AI Claims Triage Automation

At SourceCode, ai claims triage automation is designed as an orchestration layer. It connects voice bots, chatbots, OCR, and decision engines seamlessly. Claims data flows across systems without manual friction. As a result, insurers gain speed without sacrificing control.

Modular AI Capabilities Built for Insurance

SourceCode solutions combine conversational AI, document intelligence, and underwriting logic. Each module integrates into existing insurance stacks. This reduces deployment risk and accelerates time to value.

The Strategic Impact of AI Claims Triage Automation

AI claims triage automation is no longer a tactical efficiency tool. It reshapes how insurers allocate capital, manage risk, and serve customers. Organizations that delay adoption face rising costs and declining satisfaction. In contrast, leaders treat AI triage as strategic infrastructure.

Final Thoughts: AI Claims Triage Automation as a Competitive Necessity

By 2026, ai claims triage automation defines operational maturity in insurance. It enables faster decisions, smarter risk management, and scalable growth. For insurers and fintechs alike, AI-driven triage is not optional. It is the foundation of intelligent, resilient financial services.

Get in Touch

Stay Connected with sourceCode To receive regular updates on industry insights and expert perspectives, make sure to Follow sourceCode on LinkedIn now! For collaboration opportunities, cutting-edge tech solutions, or to explore career possibilities with us, please visit our website: sourcecode.com.au