The Digital Frontier: How AI and Generative Models are Transforming Fraud Detection with sourceCode

The Wild West had gunslingers, bank robberies, and bounties—today’s digital frontier has identity theft, credit card fraud, and chargebacks. Financial fraud has evolved into a multibillion-dollar criminal enterprise, fueled by advanced technologies like generative AI. In response, sourceCode is helping financial institutions leverage cutting-edge AI tools to stay ahead of increasingly sophisticated cybercriminals.

How sourceCode Helped a Leading Bank Combat Fraud with AI Solutions

When a prominent regional bank faced a surge in fraudulent activities, it turned to sourceCode for a robust, AI-driven fraud detection solution. The bank’s existing system was overwhelmed by false positives, slow transaction reviews, and an inability to adapt to emerging fraud tactics. With customers increasingly frustrated by unnecessary transaction blocks, the institution needed a partner that could deliver real-time detection and reduce disruptions.

The Challenge

The bank faced three critical issues:

- High False Positives: Legitimate transactions were frequently flagged, causing delays and customer dissatisfaction.

- Evolving Fraud Tactics: Sophisticated schemes like phishing, voice cloning, and synthetic identity fraud were bypassing traditional detection methods.

- Operational Inefficiencies: Manual reviews were time-consuming and unable to keep up with the volume of flagged transactions.

The Solution

sourceCode implemented an AI-powered fraud detection platform tailored to the bank’s unique challenges. Here’s how sourceCode’s solution transformed their operations:

- Advanced Machine Learning Models: sourceCode deployed machine learning algorithms capable of analyzing transaction patterns in real-time. The models detected subtle anomalies and flagged potential fraud faster and more accurately than the previous system.

- Behavioral Analysis with Generative AI: By integrating generative AI, sourceCode enhanced the bank’s ability to analyze customer behavior over time. The system identified deviations from typical spending habits and detected fraudulent activity with unparalleled precision.

- Graph Neural Networks (GNNs): sourceCode’s GNN technology tracked complex transaction chains to uncover hidden fraud schemes. This was particularly effective against layered money-laundering tactics.

- Reduction in False Positives: The implementation reduced false positive rates by over 70%, ensuring smoother transactions for legitimate customers.

- Enhanced Manual Reviews: sourceCode’s platform included LLM-based assistants that provided fraud review teams with context-rich insights, expediting decision-making processes.

The Results

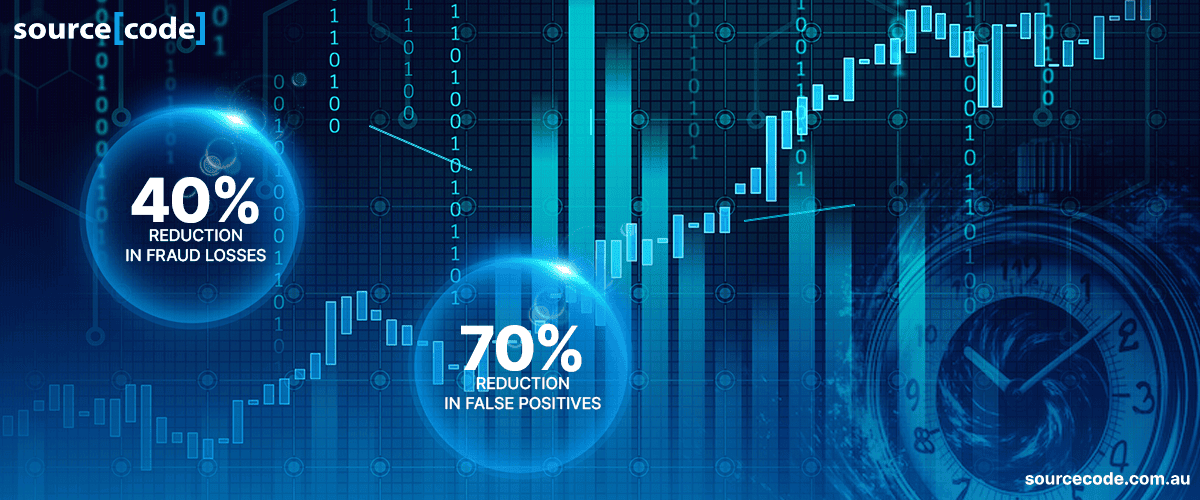

Within six months of deployment, the bank experienced:

- 40% Decrease in Fraud Losses: Real-time detection prevented fraudulent transactions before they could be completed.

- 70% Reduction in False Positives: Fewer disruptions to legitimate transactions improved customer satisfaction and trust.

- Faster Compliance: Automated KYC and AML processes enabled the bank to meet regulatory requirements with ease.

- Operational Efficiency Gains: Fraud review teams processed cases 50% faster, freeing up resources for other critical tasks.

How AI Detects Fraud Faster and More Effectively

sourceCode’s AI-powered fraud detection solutions leverage machine learning (ML) models to identify anomalies in customer behaviors and transactional patterns. Unlike traditional rule-based systems, sourceCode’s AI tools can process massive datasets in milliseconds, making them highly effective against modern financial fraud schemes.

Here’s how they work:

Pattern Recognition

sourceCode’s AI models detect deviations from normal transaction behaviors, such as unexpected foreign logins or unusually high purchases, flagging them as potential threats instantly.

Behavioral Analysis

By analyzing user behavior over time, sourceCode’s AI tools recognize deviations from expected norms, such as a sudden change in spending habits or unusual login locations.

Continuous Learning

sourceCode’s systems improve over time by learning from new data. They adapt to evolving fraud tactics, ensuring better protection against emerging threats.

Generative AI: A Double-Edged Sword in Financial Fraud

Generative AI and large language models (LLMs) have introduced unprecedented capabilities across industries, including financial services. However, they also pose significant risks when exploited by fraudsters.

The Dark Side of Generative AI

- Phishing Scams: Generative AI enables fraudsters to craft highly convincing phishing emails free of grammar mistakes, tailored for specific targets.

- Voice Cloning: Deepfake technology can clone voices using minimal samples, potentially bypassing voice authentication systems used by banks.

- Chatbot Scams: AI-powered chatbots can simulate human behavior to carry out imposter scams and financial fraud.

Harnessing Generative AI for Defense

sourceCode integrates generative AI tools to offer powerful fraud prevention capabilities:

- Enhanced Fraud Review: LLM-based assistants from sourceCode retrieve information from policy documents to expedite manual fraud reviews.

- Predictive Analytics: sourceCode’s AI predicts customer behavior to preemptively assess risks and block fraudulent transactions.

- Synthetic Data Generation: Generative AI from sourceCode creates synthetic data to train fraud detection models, improving their ability to recognize new fraud techniques.

Benefits of AI for Fraud Detection

- Fraud detection powered by sourceCode’s AI delivers significant advantages:

- Real-Time Detection: AI halts fraudulent activities instantly, minimizing financial losses.

- Improved Customer Experience: Advanced models reduce false positives, ensuring legitimate transactions are not disrupted.

- Cost Efficiency: Early fraud detection saves financial institutions millions in operational costs and reputational damage.

- Regulatory Compliance: AI supports compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations by analyzing and verifying documentation effectively.

Preparing for the Future of Fraud Prevention

As cyber threats continue to evolve, sourceCode’s AI-powered fraud detection will remain essential for financial security. Emerging technologies like generative AI and GNNs promise to make fraud detection systems more robust, accurate, and efficient. Financial institutions that embrace these tools with sourceCode will be better equipped to protect their customers and themselves.

By combining real-time analytics, predictive modeling, and explainable AI, sourceCode enables the financial sector to stay ahead of fraudsters and build a safer digital ecosystem.